Attention Small Business Owners & Entrepreneurs!!!

Get $50K–$500K in Business Funding in JUST 14 Days

with This 3-Step System

Even if you have credit challenges or a brand new startup with little income to show

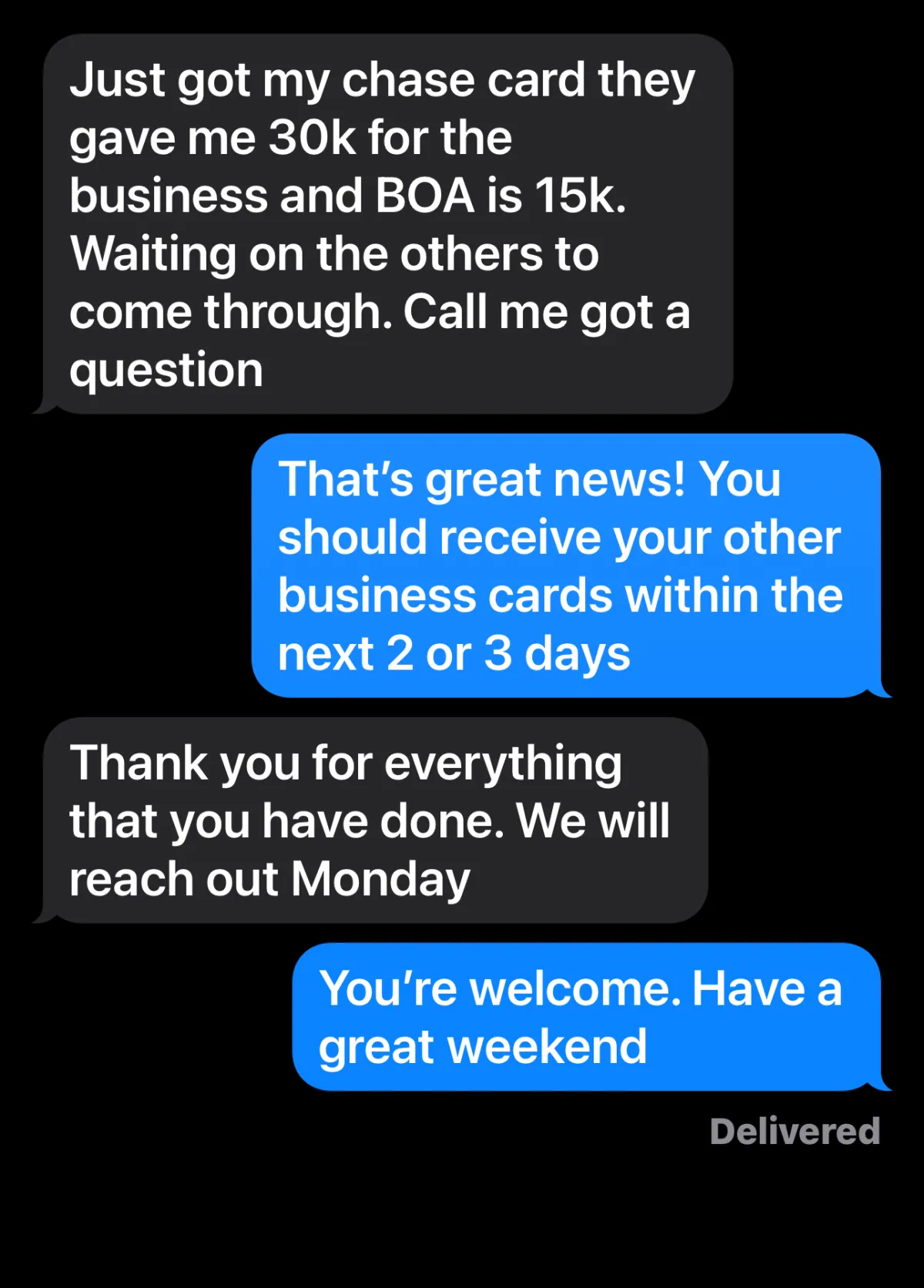

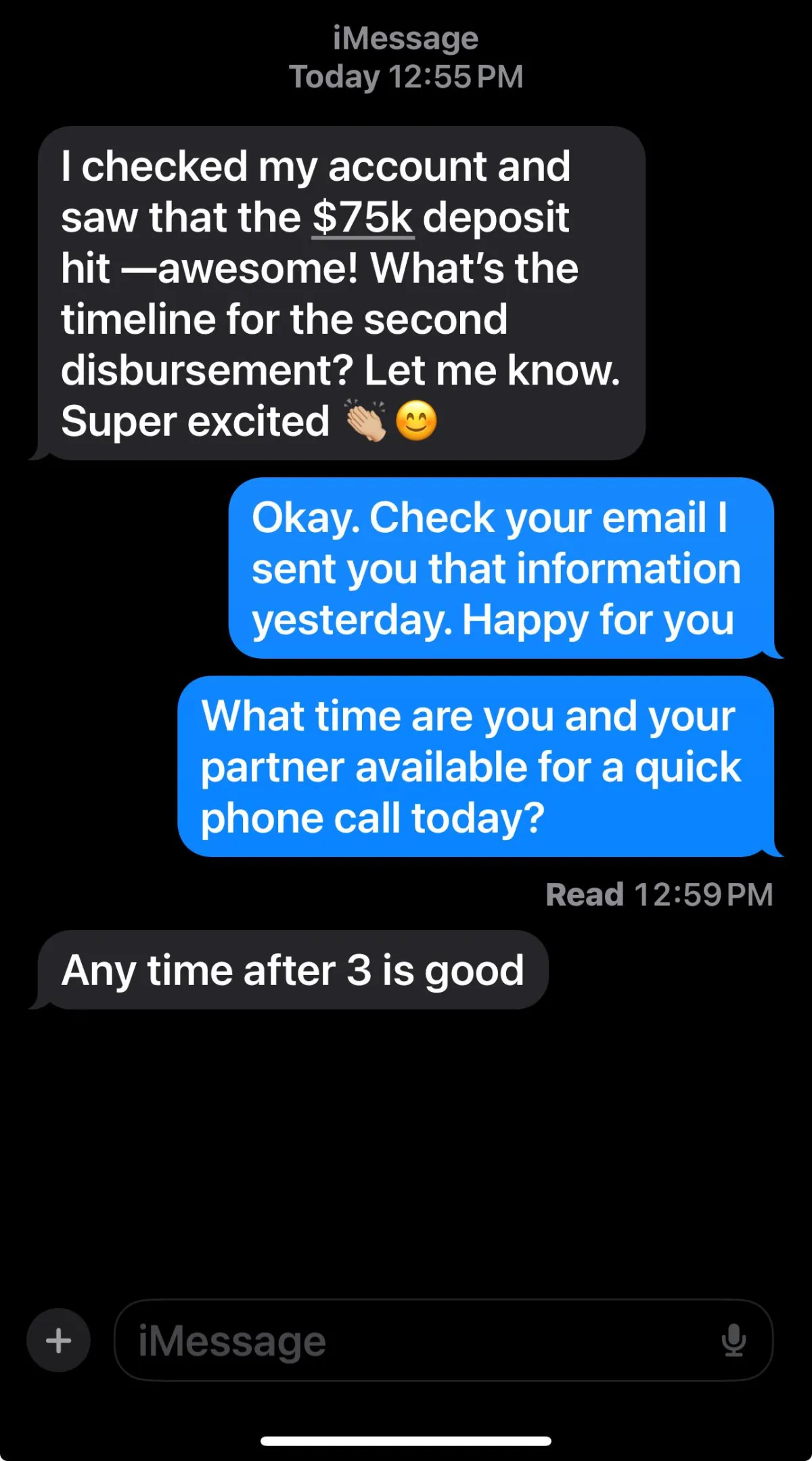

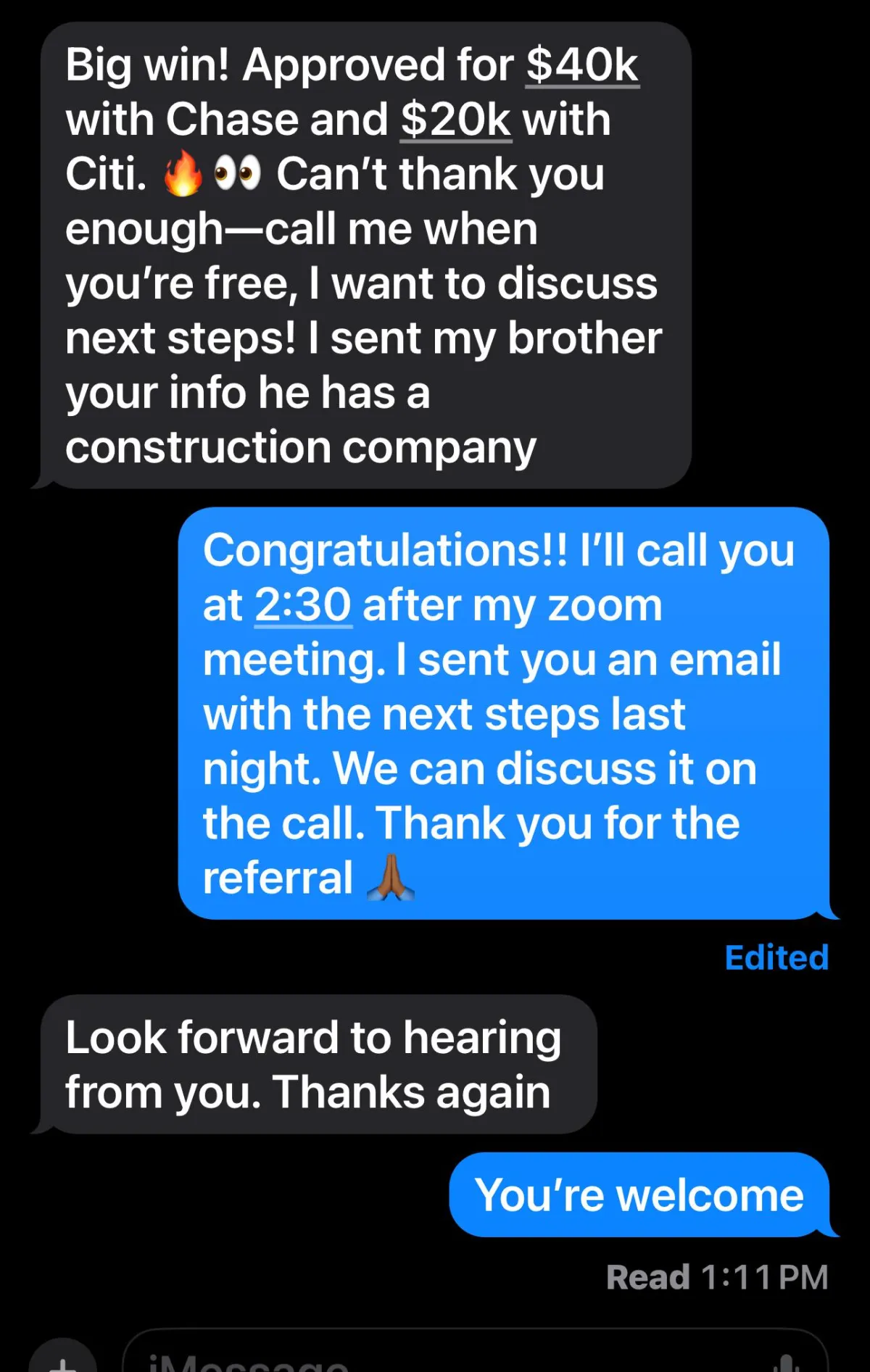

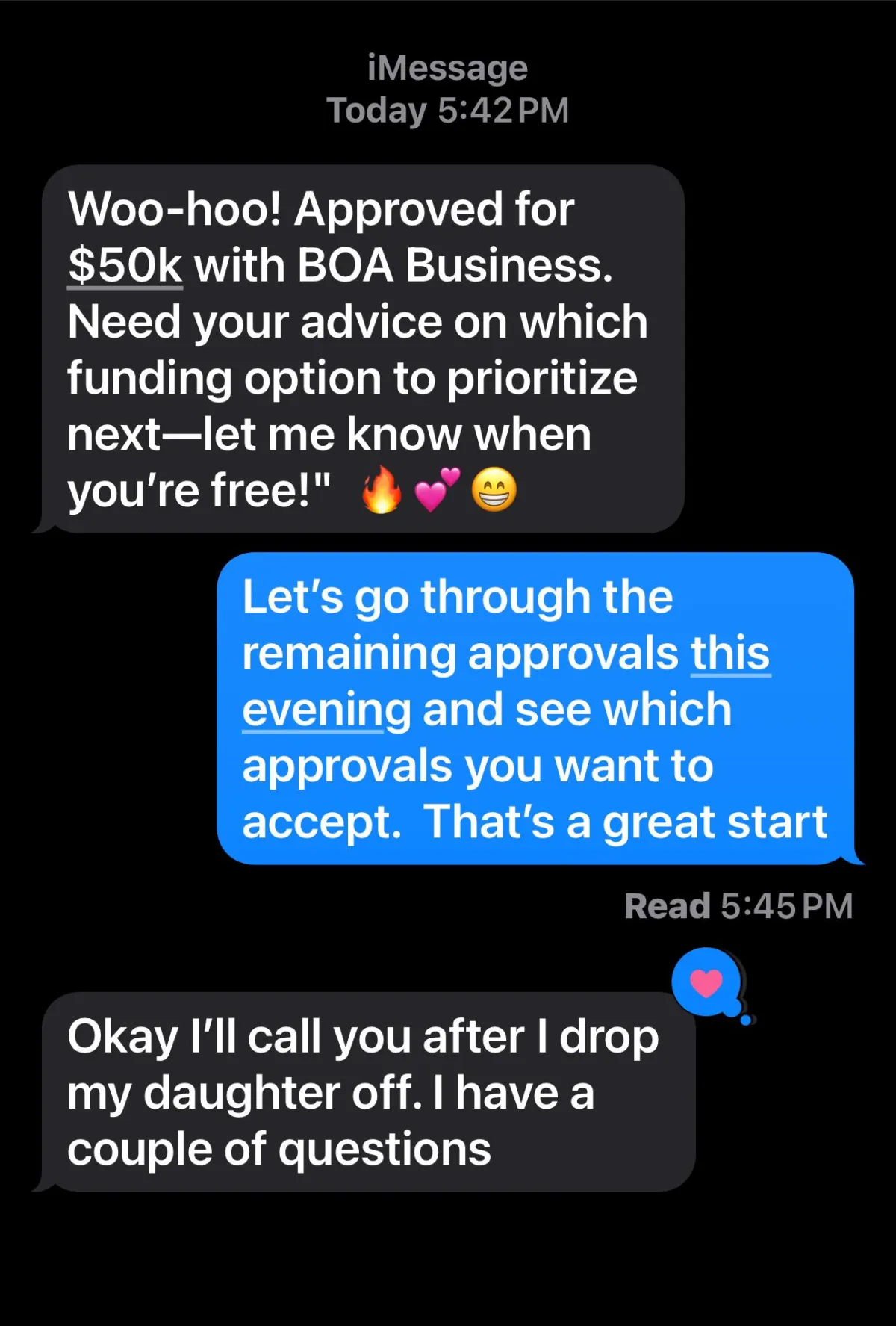

Don't Take Our Word...

Check out Our Client Results

Meet Aazim Sharp

Founder of CEO Capital Connection

A Focus on Empowering Businesses Through Strategic Funding

Having facilitated over $50 million in funding for businesses nationwide, I've gained a deep understanding of the financial hurdles entrepreneurs face. My own journey began with the same struggles many business owners experience: the uphill battle of securing adequate capital.

Early on, I encountered the frustrations of traditional lending the lengthy applications, complex requirements, and often, disappointing rejections. My goal was simple: to build a thriving business without the constant pressure of cash flow instability. This personal experience fueled my search for better solutions.

Through dedicated research and building strong relationships within the lending community, I discovered the power of strategic funding partnerships. This discovery became the foundation of CEO Capital Connection.

Overcoming the Funding Obstacles That Hold Businesses Back

You know, it's tough out there for businesses trying to get funding. We see it all the time: strict bank rules, limited choices, and feeling like you're just another number. It's frustrating.

At CEO Capital Connection, we get it. We've built our business around tackling these challenges head-on. Whether you're a startup or an established company, with great credit or some bumps in the road, we're here to help.

We've got connections with tons of different lenders, so we can find the right fit for your situation. And we don't just hand you a list of lenders and wish you luck – we're with you every step of the way, offering expert guidance to make the whole process smoother. Because, really, getting funding shouldn't feel like pulling teeth. It should be a partnership.

Our RECENT Case-study

Case Study 1

Trucking Business Expansion

Funding Secured: $250,000

Problem: A rapidly growing trucking company needed funding to expand their fleet but struggled with getting approved for traditional loans.

Solution: We helped them secure $250,000 in funding within two weeks through our network of specialized lenders, allowing them to purchase new trucks and increase their shipping capacity.

Outcome: The business expanded by 50% within six months, meeting the rising demand and increasing revenue significantly.

Case Study 2

Retail Store Expansion

Funding Secured: $100,000

Problem: A boutique retail business wanted to open a second location but lacked the capital needed for lease agreements and inventory purchases.

Solution: We secured a $100,000 funding package at 0% interest for 12 months, giving them the financial flexibility to grow.

Outcome: The new location was fully operational within three months, leading to a 35% increase in overall sales.

Case Study 3

Tech Start-up Scaling

Funding Secured: $400,000

Problem: A tech start-up needed funds to hire key talent and scale operations but faced challenges in navigating various funding options.

Solution: We tapped into our lender network and secured $400,000 in funding with competitive rates, helping them scale quickly and hire top talent.

Outcome: The start-up doubled its team size and is on track to launch its next phase of growth.

No More Struggling with Inconsistent Cash Flow and Dealing with Missed Opportunities and Sleepless Nights.

I’ve been in your shoes and know what it feels like to turn down profitable projects due to lack of capital.

If you’re reading this, maybe you struggle with unpredictable cash flow and the constant fear of not being able to meet your financial obligations...

You’re tired of the fear of losing your financial security and feeling the anxiety of not knowing where the next payment will come from...

If this sounds like you, CEO Capital Connection was created to help you achieve your goals.

If this sounds like you, CEO Capital Connection was created to help you achieve your goals.

There’s a Better Way to Fund Your Business Growth

And it’s not doing more of what you’ve already tried... (Long bank applications, endless paperwork, and frustrating rejections.)

Get Funding Fast (Pre-Approvals in 10 Minutes)

Need funding quickly? Get a pre-approval estimate in just 10 minutes—without impacting your credit. See how much you qualify for from multiple lenders and get funded in as little as 14 days.

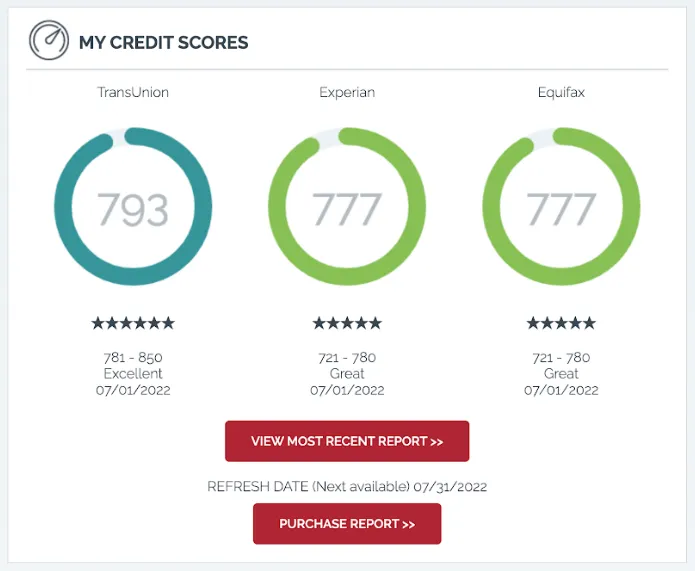

Get Funded Even With Imperfect Credit

Don't let past credit challenges hold you back. We understand that every business is unique, and we leverage our exclusive access to lenders' unadvertised credit requirements and internal guidelines to secure funding.

Access More Funding Options (Hundreds of Lenders)

We're not a bank. We connect you with hundreds of lenders to find the perfect funding solution for your business, whether you need a term loan, line of credit, merchant cash advance, or SBA loan. Get more funding, faster, than you could on your own.

Expert Guidance Every Step of the Way

Confused about funding? Our experts guide you through the entire process, from choosing the right option to navigating the application. We know how to maximize your approvals, even if you have imperfect credit.

Low Rates & Flexible Terms (Including 0% for 18 Months)

Get access to low-interest options, including rates as low as 0% for up to 18 months, giving you the flexibility you need to grow without financial strain.

Only Pay When You Get Funded (Success Fee)

We only charge a success fee—and only after you receive your capital. No upfront costs, no hidden fees, just transparent pricing.

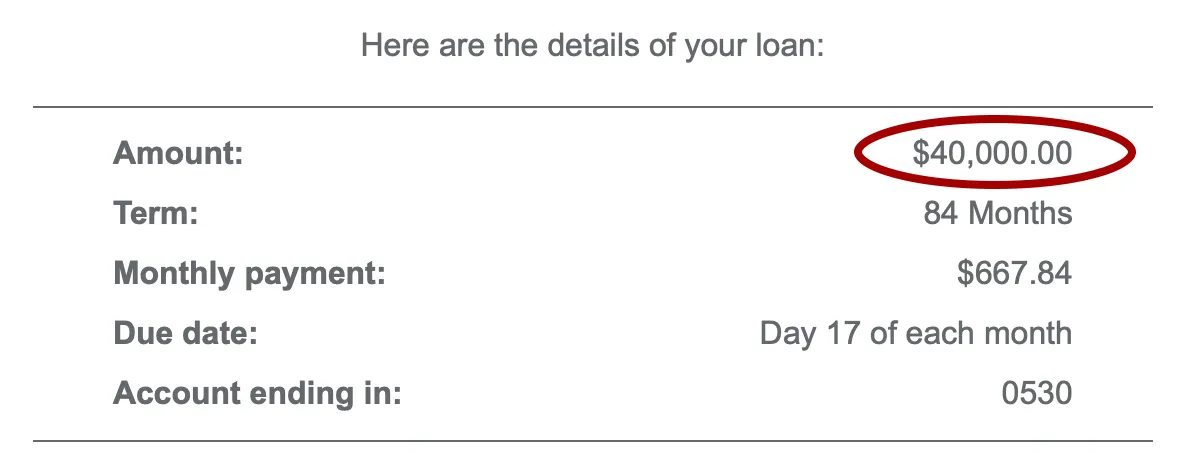

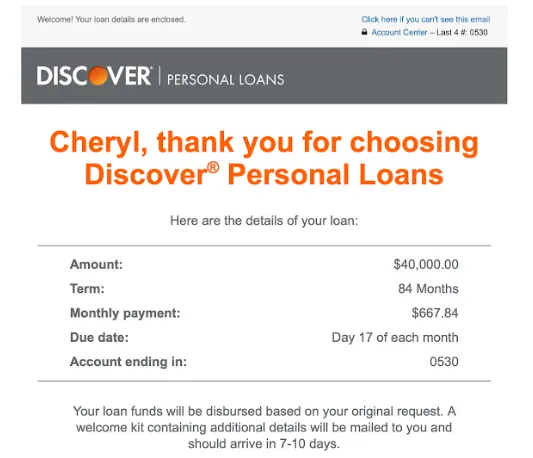

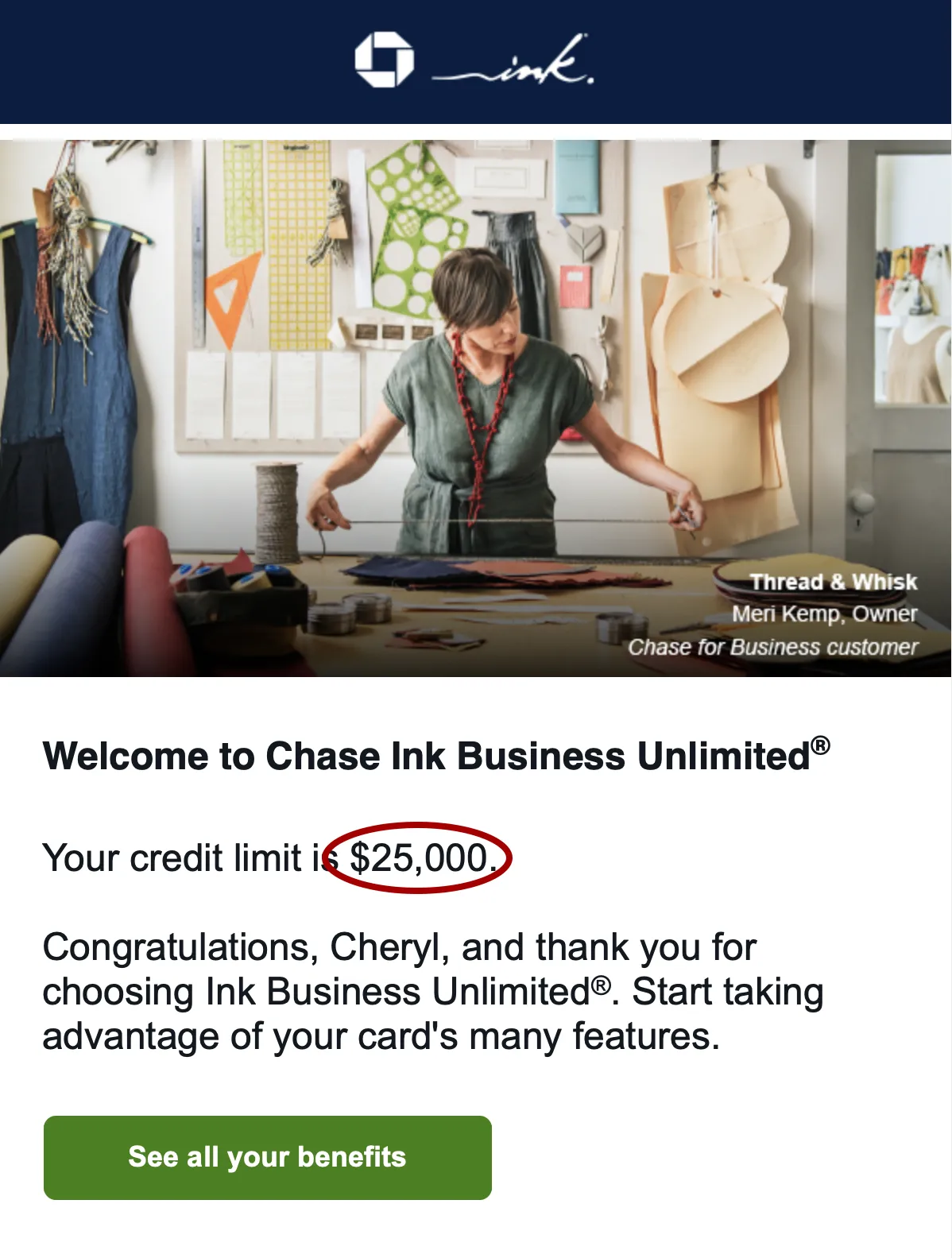

Real Clients. Real Results

BOOK FREE 1-1 CONSULTATION CALL

👉 Select a time that works best for you.

👉 Fill out the form accurately so we can understand your business needs.

👉 Our team will prepare a personalized plan to your desired funding.

75+

Over 75+ businesses funded this year alone, helping them achieve their growth goals.

$50M+

Over $50 million in total funding secured for small businesses nationwide, fueling their success.

$200K+

Average funding amount secured for our clients with significant capital for expansion, inventory, and more.

Don't Take Our Word

Check out Our Clients Are Saying...

This works for hundreds of others and can work for you with our Done For You Service!

CEO Capital Connection helped

me open my first restaurant!

"I secured $200,000 in funding to renovate a building and buy equipment for my dream restaurant. Aazim and his team made the process so easy, and now, my restaurant is thriving in the local community!" - Maria C.

We opened our boutique with CEO Capital Connection!

"My wife and I always dreamed of opening a boutique, and thanks to CEO Capital Connection, we secured $90,000 to make it happen. Now, our shop is the talk of the town!" - Stephanie & James T.

From startup to success!

"I was struggling to secure funding for my e-commerce business until I found CEO Capital Connection. They helped me get $100,000, which I used for inventory and marketing. My online store has seen a 3x growth in sales since!" - Jack F.

Funding to grow my law firm!

"As a small law firm, securing financing is tough. CEO Capital Connection helped me obtain $120,000 to hire more paralegals and expand our office. The increase in clients and revenue has been incredible!" - Daniel W.

Amazing Bonuses When You Book Your Free 1-1 Consultation Today

Here’s everything you get included when you schedule your free funding consultation:

BONUS 1

THE 3-STEP FUNDING BLUEPRINT

This proven blueprint reveals the exact steps to securing the funding you need to grow your business.

Have a strategic funding plan set in place today and long into the future. Build a sustainable funding strategy for long-term growth and stability.

BONUS 2

Total Credit Transformation

This invaluable guide empowers you to take control of your credit and unlock even more funding opportunities.

Remove negative items from your personal credit. Learn proven strategies to address collections, charge-offs, foreclosures, bankruptcies, judgments, and repossessions.

Frequently Asked Questions

What is the cost of your service?

Our fee is a 9% success fee, meaning you only pay after you receive your funding. This fee covers our expertise in navigating the complex funding landscape, our access to a wide network of lenders, and the personalized guidance we provide throughout the entire process. In some cases, we can contractually agree to cap the fee at $7,500, or 9%, whichever is less. There are no upfront costs or hidden fees.

How long does the funding process take?

Our streamlined process aims to get you funding as quickly as possible. In many cases, we can secure funding within 14 days. However, the exact timeline can vary depending on the specific funding solution and lender. We'll provide you with a realistic timeline during your initial consultation. We also offer pre-approvals within 10 minutes to give you a quick estimate of your funding potential.

What are the eligibility requirements?

We work with businesses of all sizes and credit profiles. While certain lenders have specific requirements, our extensive network allows us to find options for businesses even with less-than-perfect credit. We consider various factors beyond just credit score, such as business revenue, time in business, and cash flow. We encourage you to contact us for a free consultation to discuss your specific situation.

How secure is my information?

We understand the importance of data security. Our entire process is conducted online using secure, encrypted platforms. We adhere to strict data privacy protocols to protect your sensitive financial and personal information. We never share your information without your explicit consent.

Can you really get me more funding than I could get on my own?

Yes, in many cases, we can help you secure significantly more funding than you could independently. This is due to our deep understanding of lender requirements, our access to a wide network of lenders (including those not readily accessible to the public), and our expertise in strategically positioning your application. We know what lenders are looking for and how to present your business in the best possible light.

Are there any hidden fees?

Absolutely not. We believe in complete transparency. Our 9% success fee (capped in certain cases) is the only fee you'll pay, and it's only due after you receive your funding. There are no application fees, processing fees, or any other hidden costs.

Why should I use your service instead of applying for funding myself?

Applying for funding can be a time-consuming and complex process. We save you time and effort by handling the heavy lifting, from researching lenders to preparing and submitting your application. We also leverage our expertise and network to maximize your chances of approval and secure better terms than you might be able to obtain on your own. Think of us as your funding experts, working on your behalf.

Is the virtual process secure?

Yes, our fully virtual process is designed with security in mind. We use secure, encrypted platforms for all communications and document sharing. This ensures the confidentiality and integrity of your information.

Ready for a personalized plan to get you up to $500K Funding?

Due to high demand, consultation slots are filling up quickly. Book your free consultation now and receive The 3-Step Funding Blueprint & Total Credit Transformation Guide.

Copyrights by ceo capital connection ™ 2024 | Privacy policy | Terms & Conditions

This site is not a part of the Facebook™ website or Facebook™ Inc. Additionally, this site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc.